This isn’t just a tool to show your earnings — it’s a lens into your business’s true performance. A margin calculator goes beyond revenue, helping you see what portion of every dollar you keep. Whether you're evaluating company-wide metrics with a gross profit margin calculator or dialing in product pricing with a unit-specific margin tool, it all comes down to one thing: smarter insights for smarter decisions.

In an era where pricing can define success or failure, a margin calculator helps you stay competitive without selling yourself short. The best part? You don’t need to be a finance expert to use it. With just your cost and price — and maybe a calculator to handle profit percentages — you can make sharper, more confident choices in minutes.

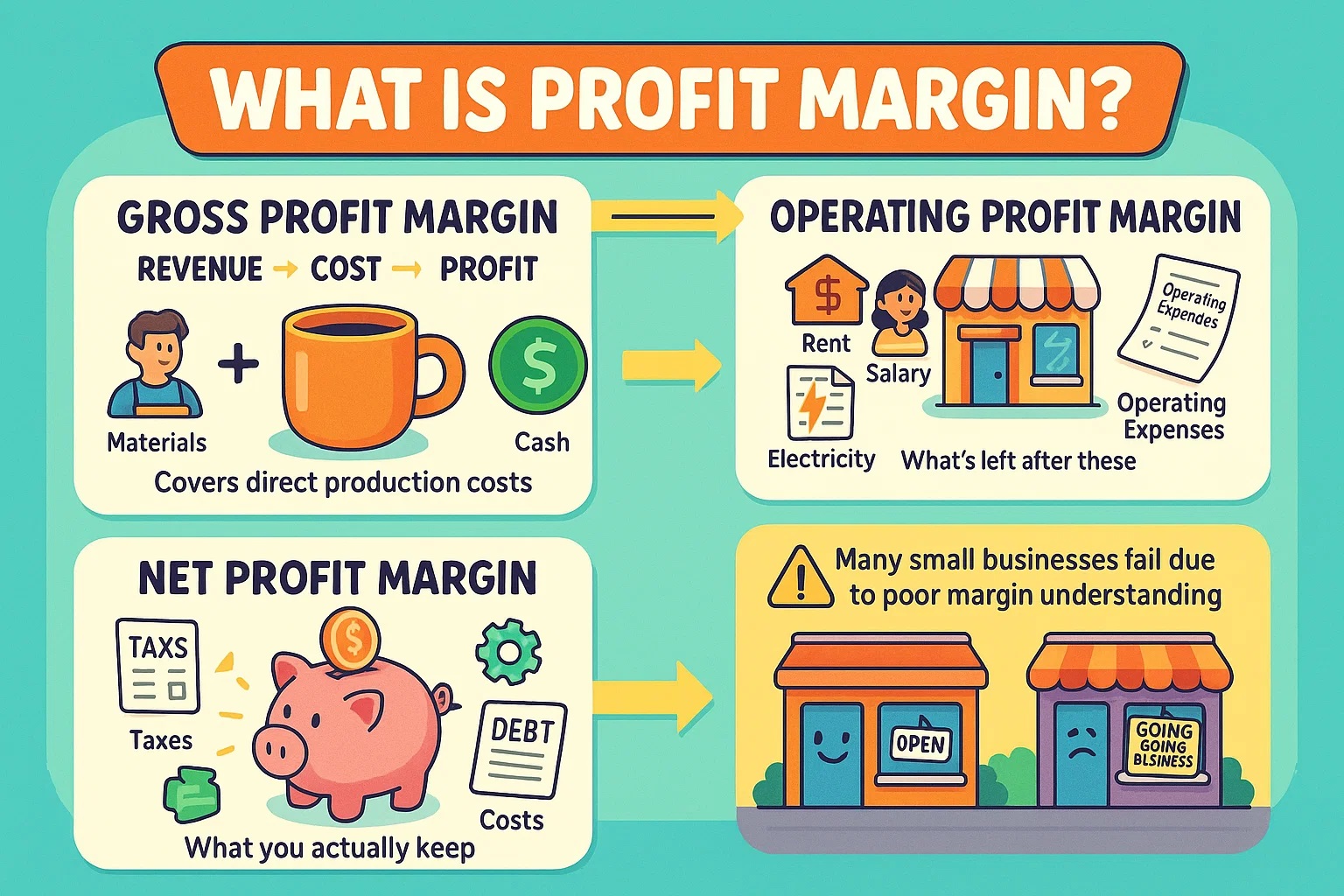

What Is Profit Margin?

Making money isn't the same as making a profit — and that’s where profit margin comes in. It’s a straightforward but powerful percentage that shows how much of your sales revenue becomes actual profit.

In simple terms, profit margin reveals how effectively you turn sales into income. It gives you a clear view of how each transaction contributes to your bottom line.

Here are the key types:

-

Gross profit margin shows what’s left after covering direct production costs like materials and labor. It's a great way to check if your pricing is sustainable.

-

Operating profit margin takes overhead into account — rent, wages, utilities, etc. It tells you how efficient your business is at managing everyday expenses.

-

Net profit margin is the full picture, including taxes, debt, and one-time costs. It’s your real-world, take-home profit.

Why should you care? Because on the surface, a business might look profitable — but without understanding margins, you could be flying blind. The U.S. Small Business Administration lists poor financial management as a top reason small businesses fail, and ignoring margin is a big part of that

Margin vs. Markup

People often confuse margin with markup. They sound similar, but they measure two completely different things — and mixing them up can lead to pricing mistakes.

-

Margin is: the percentage of your revenue that’s actual profit. It’s calculated based on the final selling price.

Margin = (Revenue - Cost)/ Revenue 100%

- Markup: on the other hand, is how much you increase your cost to reach a selling price. It’s based on the cost itself.

Markup = (Revenue - Cost)/Cost 100%

Example: With a product selling for 200 and a production cost of 150, the Markup would be

Markup = (2000 - 150)/150 100% = 33.33%

Imagine this:

-

You run a coffee shop.

-

You buy coffee beans for $5 a bag.

-

You sell cups of coffee made from that bag for $10.

If you marked up the beans, you'd say: "I doubled the cost. That’s a 100% markup."

But if you look at the margin, it’s this:

(10−510)×100=50%

Your margin is 50% — not 100%.

Same numbers, different lenses. If you're using a profit margin calculator, make sure you're measuring the right side of the equation.

How to Calculate Different Profit Margin

If you want to know how much you're really making after expenses, margin calculations give you the full picture. Each type offers a different view of your financial health.

-

Gross Margin

This tells you how much profit remains after direct costs.

Gross Margin (%) = (Revenue − Cost of Goods Sold) / Revenue × 100

Example:

If you earn 500 and your production cost is 300

(500 – 300) / 500 × 100 = 40%

You keep 40 cents for every dollar earned — a strong indicator your pricing covers core costs.

-

Operating Margin

This dives deeper, factoring in operational costs like salaries, rent, and utilities.

Operating Margin (%) = Operating Profit / Revenue × 100

Example:

75 in operating profit on 500 in revenue:

75 / 500 × 100 = 15%

That means 15% of your revenue remains after you’ve paid for the day-to-day work of running your business.

-

Net Margin

This is the all-in number — what’s left after taxes, interest, and non-operational costs.

Net Margin (%) = Net Profit / Revenue × 100

Example:

50 net profit on 500 revenue:

50 / 500 × 100 = 10%

You’re earning 10 cents per dollar after everything’s paid.

-

Contribution Margin

Do you want to know which product is truly profitable? Contribution margin focuses on individual items and their variable costs.

Contribution Margin (%) = (Revenue − Variable Costs) / Revenue × 100

It’s great for deciding what to promote, adjust, or cut entirely.

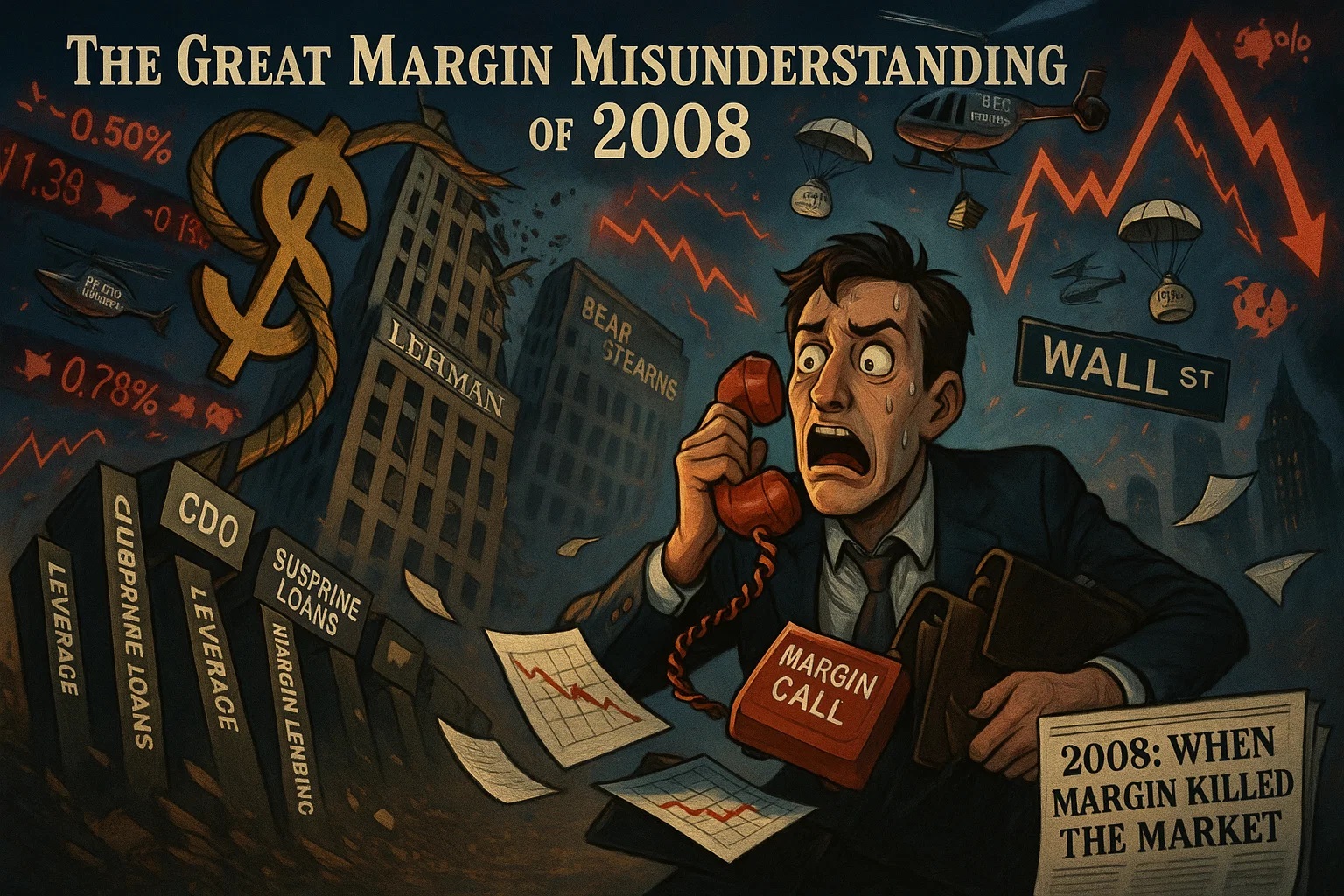

The Margin Mistake That Helped Crash the Economy

Back in 2008, the word "margin" wasn’t just business jargon — it was a key player in a global financial meltdown.

Financial institutions had piled into mortgage-backed securities and risky loans, often using borrowed money — margin — to buy more than they could afford. When home prices dropped, lenders called in those debts. Companies like Lehman Brothers couldn’t pay, leading to mass sell-offs, bankruptcies, and bailouts.

What made things worse wasn’t just bad debt — it was the blind faith in margin-based investing. The speed at which borrowed money turns into crisis was wildly underestimated.

Margins in Finance: Beyond Business Basics

In the world of finance, “margin” takes on a more complex meaning. It’s all about leverage, risk, and investment strategy.

Currency Trading Margin

Forex traders don’t use their full capital for trades. Instead, they put down a small percentage, called margin, and borrow the rest from their broker.

While this allows for big gains with small inputs, it also means losses are magnified. A tiny shift in currency values can erase your margin in seconds.

Need clarity? Use the Currency Exchange Margin Calculator to see your exposure before you trade.

Stock Trading Margin

In stock markets, margin lets you borrow money to buy more shares. But if your investments drop, brokers demand immediate action — known as a margin call.

To avoid surprises, plug your numbers into the Stock Trading Margin Calculator — it could save you from costly mistakes.

Who Regulates Margin Trading?

In the U.S., margin activity is monitored by the SEC and FINRA. They set rules like Regulation T, which requires investors to fund at least 50% of a stock purchase with their own money.

Brokerages may impose stricter limits based on your account history, portfolio volatility, or market conditions. So, even two people buying the same stock might have very different margin terms.

No matter your investment size, margin isn’t just about gaining buying power — it’s about understanding your risks and staying in control.